Any changes on the horizon? From what I heard from Warhorse, there were pretty much no changes.I work @ Crazy Labs, so I guess we got Embraced

|OT| Embracer Group's (ex-THQ Nordic AB) acquistion spree | Koch Media renamed to Plaion, Asmodee to Twin Sails

- Thread starter prudis

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

So I guess 3D Realms could in theory release new Duke games now without Randy taking them to court (Release the pre-2011 builds now!).

There has got to be some kind of EU government body that looks into a corporation like this that just gobbles up other companies endlessly, right? Like Embracer is just huge.

There has got to be some kind of EU government body that looks into a corporation like this that just gobbles up other companies endlessly, right? Like Embracer is just huge.

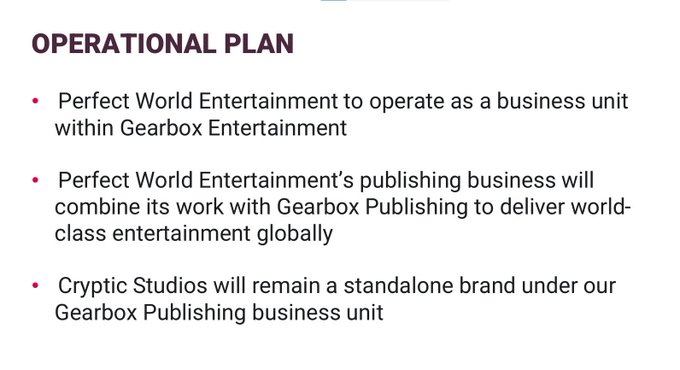

Perferct World Acqired to be under Gearbox

+ random mostly GFX /porting stuios under various other labels

Embracer Group AB (“Embracer”) has entered into an agreement to acquire 100 percent of the shares in Perfect World North America Corporation and Perfect World Publishing B.V. (collectively “Perfect World Entertainment” or “PWE”)[1], from Perfect World Europe B.V. (“Perfect World”). PWE is a video game developer and publisher for PC and consoles, including PWE Publishing and Cryptic Studios. The acquisition adds on a total of 237 employees. The purchase price for the acquisition comprises a one-time payout of USD 125 million, divided into of USD 60 million in cash and USD 65 million in B shares of Embracer subject to consideration adjustment at closing. The purchase price net of cash amounts to USD 103 million.

[1] Acquired through Embracer and will be part of the Gearbox Entertainment operative group.

+ random mostly GFX /porting stuios under various other labels

also Dark horse comis

Embracer Group AB ("Embracer") has today entered into an agreement to acquire Dark Horse Media, LLC (“Dark Horse”), a leading entertainment company. Post-closing, Dark Horse will become the tenth operative group of the Embracer group. Through the acquisition, Embracer strengthens its transmedia capabilities by adding expertise in content development, comics publishing, and film & TV production. Dark Horse owns or controls more than 300 intellectual properties, many of which are attractive for future transmedia exploitation, including the creation of new video games. Dark Horse founder and CEO Mike Richardson will continue to lead the company together with existing management.

I didn't know about this, but Embracer is having a big archive of all old games located in Karlstad, Sweden. Currently it's available for public but they intend to open it so people can visit the archive

embracer.com

embracer.com

Games Archive - Embracer

when your acquisition's acquisition's acquisition makes an acquisition

Well this is fucking huge

Square's western branch has been Wingeforsed.

Warhorse and Eidos Montreal under one roof.

Square's western branch has been Wingeforsed.

Warhorse and Eidos Montreal under one roof.

Embracer Group AB (”Embracer”) has entered into an agreement to acquire the development studios Crystal Dynamics, Eidos-Montréal, Square Enix Montréal, and a catalogue of IPs including Tomb Raider, Deus Ex, Thief, Legacy of Kain and more than 50 back-catalogue games from SQUARE ENIX HOLDINGS CO., LTD. (“Square Enix Holdings”). In total, the acquisition includes ~1,100 employees across three studios and eight global locations. The total purchase price amounts to USD 300 million on a cash and debt free basis, to be paid in full at closing. Embracer has secured additional long-term debt funding commitments for this and other transactions in the pipeline. The company today reiterates its current Operational EBIT forecast for FY 21/22, FY 22/23, and FY 23/24. The transaction is subject to various regulatory and other external approvals and is expected to close during the second quarter of Embracer’s financial year 22/23 (July-September 2022).

Embracer will hold a webcast presentation for investors, analysts and media on 2 May 2022 at CET 09.00. Please find details in a separate invitation that will follow this release.

”We are thrilled to welcome these studios into the Embracer Group. We recognize the fantastic IP, world class creative talent, and track record of excellence that have been demonstrated time and again over the past decades. It has been a great pleasure meeting the leadership teams and discussing future plans for how they can realize their ambitions and become a great part of Embracer,” says Lars Wingefors, Co-founder and Group CEO, Embracer Group.

”Embracer is the best kept secret in gaming: a massive, decentralized collection of entrepreneurs whom we are thrilled to become a part of today. It is the perfect fit for our ambitions: make high-quality games, with great people, sustainably, and grow our existing franchises to their best versions ever. Embracer allows us to forge new partnerships across all media to maximize our franchises’ potential and live our dreams of making extraordinary entertainment,” says Phil Rogers, Square Enix America and Europe CEO.

so basically whole of former Eidos Interactive (- IO who escaped earlier) .... and 300m $ (for xomparision Square bought Edios for 130m$ back in 2009)

Last edited:

I don't like how Embracer is buying half of the games industry. But no doubt these studio's and IP's will be better managed by them than by Square Enix. This move also makes it easier for me to ignore Square completely.

$300 mil for Crystal Dynamics and Eidos Montreal seems like a steal to be honest. I hope we will see some IPs revived ( fingers crossed for Soul Reaver).

for comparision:

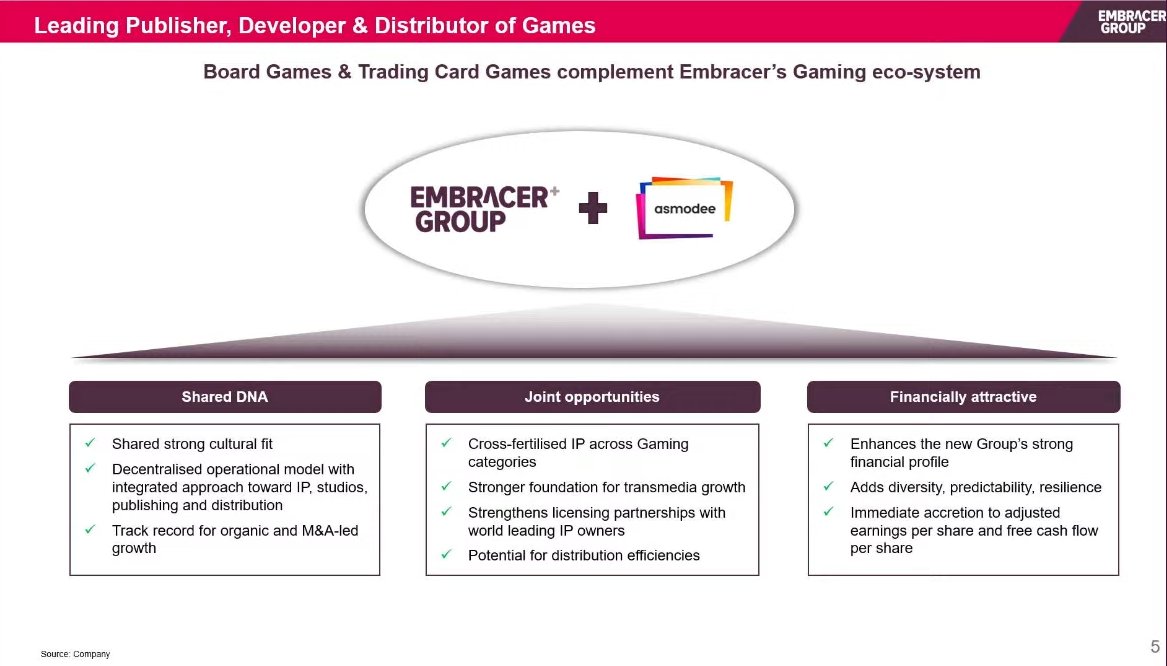

would not have guessed Asmodee was valued at nearly $3 billion... their board games must be really popular

I can see why Aspyr would be an attractive purchase. They have experience porting games, in particular to mobile and consoles, which is likely something a massive IP conglomerate like Embracer would find valuable. Their IP, studio and publisher landgrab is about building up a colossal amount of IP which they can then license out to the service providers, or even make their own subscription service. All those old games need to be working on modern hardware if the plan is to succeed and Aspyr can be very useful not only in doing the work, but also in terms of setting up processes in and sharing experience with all the other Embracer studios.Aspyr Media who probably doesn't have any own IPs costed more to acquire than Crystal Dynamics/Eidos. That's a surprise

It's the same reason why Sony acquired Nixxes and Bluepoint. They've got a whole lotta games that they need up and running on PC, PS5 and Azure cloud gaming servers.

As a long-term investment, especially when other big publishers likely made offers too, Aspyr was probably a good strategic purchase.

I read somewhere that the price of Aspyr was ~100 million USD and ~300 million USD bonus in case certain conditions are met.Aspyr Media who probably doesn't have any own IPs costed more to acquire than Crystal Dynamics/Eidos. That's a surprise

That seems more reasonable.

some interesting quotes:

basically how the operation groups work:

Wingefors emphasised that, unlike some of the other industry giants aggressively scooping up key players in the space, Embracer Group operates differently. While Zynga, for example, is being integrated into new parent Take-Two Interactive, every Embracer-owned entity operates autonomously. THQ Nordic, Koch Media, Saber Interactive (and so on) conduct themselves as separate businesses. The ecosystem the CEO speaks of is the threads that tie these together and enable collaborations where those companies see fit.

The role of Embracer, he tells us, is to enable those businesses to focus on their own ambitions and support those where possible.

so they still dont know when they will put them ex-Edios folks

Naturally, Embracer is still in the process of signing and closing that deal, so the exact structure of Tomb Raider and the other former Square Enix IP and assets is yet to be decided. But Wingefors remains highly confident in the management at each of the three studios and says they will "operate with a great deal of autonomy."

How they plan with IPs

Wingefors observes that these are "very traditional IPs" -- after all, Tomb Raider, Thief and Legacy of Kain all debuted in the 1990s, with Deus Ex following in 2000. As such, the CEO says expectations of any financial return needs to be reasonable. He sees strong potential in the series' back catalogues, opening up the possibility of ports, remakes and remasters, and there are even opportunities for collaborations across the group. But what happens next inevitably comes down to the question of cost.

"Should we make something new? Should we do some licensing, or work for hire? If you have really strong AAA IPs in the group -- and I'm not necessarily talking about Tomb Raider in this case -- that makes that work easier," he says.

We will take good care of the people, the IPs, and if we set reasonable expectations, I think we will also be happy with the financial performance on this. Could you do things that are more lucrative in this industry? For sure. But that doesn't mean to me that you need to always maximise, and only do things that have the highest potential for the highest margins. If you do that, your business will become quite boring after some time."

The "no need for 10x over profit margins" and IP crossmedia plans

And obviously, when you have an IP such as Tomb Raider, you can look a lot at the historical outcomes. I run my business on absolute numbers, not to percentages. And if you invest whatever, not talking necessarily about Tomb Raider, but a big AAA -- let's say you're investing $150 million and you bring in $300 million, or $250 million. That might be okay. You don't have to do 10X over some period of time. And you can always work with platform holders, you can do collaborations, you can do some de-risking on the financing. Obviously with iconic IPs, you can bring that IP to other media and companies where you can have some more profits coming through."

Long term IP plans

Wingefors stresses that Embracer and its companies think "super long-term" about any IPs they acquire, before sharing more insight into the process. First, a company will begin with remastering work for titles that could benefit from it. These old games are then used to prove whether there is a market for more -- if fans cry out for a sequel, Embracer's businesses are listening.

The group is going through this process with a number of IPs. Wingefors describes THQ Nordic as "still in the remastering/remakes phase" but teases that the publisher will release "some amazing things over the coming years." But such products, he says, take a decade or more to build up to.

Problematic classic IPs

The problem with a few IPs is that the world has moved on," Wingefors says. "Expectations of sequels are quite enormous, and it could be game styles that are very expensive to make nowadays in the modern world. I don't want to highlight a specific IP, but we have some iconic IPs that are difficult to actually find a business case on, because if you do it properly, they cost at least $30 to $50 million to make. And you need to put a very good team on it. So, that makes the business case difficult sometimes."

"I'm not saying that it's for Thief," Wingefors adds. "But that is always something we need to consider. Thief is a fantastic IP. I know there's a huge fanbase for that, so I'm sure my team will look deeply into that, and there is a lot of love for that IP also coming with the transaction."

About pandemic:

"The pandemic found a lot of new players and audiences across the world that enjoy games, and find gaming very social and entertaining," he says. "I still believe there will be growth in the gaming industry this year, and even though a few KPIs showed weakness in the first quarter, there are some other KPIs showing better progress. So, I'm optimistic. I think the underlying market is very strong. PC gaming is greater than ever. I think there is a continued super demand for PlayStation 5, Xbox, and a strong demand for Nintendo, and people can't get enough of mobile gaming.

"if we set reasonable expectations"

Already doing better than Square ever did.

Already doing better than Square ever did.

Goodbye Koch Media

Today marks an exciting day in the history of Koch Media by rebranding into PLAION.

www.gamesindustry.biz

www.gamesindustry.biz

Today marks an exciting day in the history of Koch Media by rebranding into PLAION.

Kundratitz also hopes the new identity will make more of an impact internationally than Koch did.

"We have made such an enormous transformation since we joined the Embracer Group," he said. "Our name for so many years was associated with physical distribution, perhaps with us being more of a central European company – although including the UK because that was among the first three countries where we launched. But we're perhaps not seen as a global company. And it's sometimes difficult for some people to pronounce."

For those wondering, the 'ch' in Koch is not pronounced the way you would think. Plaion, meanwhile, is pronounced exactly as you would expect: like 'Play on,' a phrase Kundratitz hopes to evoke for both the company's games and film business. The logo has even been designed around the universally recognised triangular symbol for 'play' with the 'io' styled to resemble a one and zero – a little binary Easter egg to emphasise the company's digital operations.

That said, for all the film and TV connotations associated with the 'play' symbol, Kundratitz emphasised that Plaion is "first and foremost a games company."

"It's nine-to-one compared to the size of the film business," he explained.

"Koch has always been a B2B brand and it will continue to be," Kundratitz said. "All our consumer-facing publishing labels – Deep Silver, Prime Matter, Ravenscourt, Milestone and Vertigo Games – will stay the same. I think it's easier to transition from Koch to Plaion in a B2B environment."

The new brand will also apply to Koch Film, which is now Plaion Pictures, although the various games publishing labels remain unchanged.

Kundratitz said the timing is especially good as it comes just ahead of Gamescom, where Plaion will have a big presence and new announcements to cement the rebrand in people's minds. He also added that Plaion is far from the only company dramatically reinventing its image.

Koch Media rebrands as Plaion to "acknowledge who we truly are"

As of today, Koch Media is no more. Instead, the company will now go by a new moniker: Plaion.

JFC

koch as a name was bad enough, but this might just be even worse

koch as a name was bad enough, but this might just be even worse

Should have embraced the dick jokes and just called themselves Cock Media.

Less likely to get phallic mispronunciations with this one at least.JFC

koch as a name was bad enough, but this might just be even worse

Could be worse, at least they are not the American Koch family/industries.Changing your name doesn’t change the fact that you are a Koch.

and another rebrand

While Asmodee Digital initially focused on board games, its catalog has grown to accommodate new experiences and indie games, leading to an evolution in its identity and its change in branding.

As Twin Sails Interactive, the company will focus on original experiences, combining independent and AA titles on consoles and PC alongside industry leading partners. Former Asmodee Digital COO Nicolas Godement is now the company’s managing director.

“We aim to become a leading game publisher, which means three things to us: a great line-up of high quality, creative titles; an amazing team of passionate game professionals; and a work environment that feels both safe and fun,” Godement said in a press release. “By limiting the number of releases per year, we are thus able to fully commit the relevant resources needed for the success of each project.”

Onoma isn't a great name, reminds me a bit too much of "omnomnom" but I guess they couldnt exactly keep "Square Enix Montréal"

Reason: typo goddammit

Last edited:

They couldn't use Square Enix' random name generator?

as for the whole new operative group , seems like they will use the historical pre-Squeenix name according to trademarks form Onoma website

btw, eurogamer reported that onoma just means "name" (in Greek)

www.eurogamer.net

www.eurogamer.net

Square Enix Montréal is now Studio Onoma following Embracer acquisition

Square Enix Montréal - the developer behind the likes of Hitman Go and Lara Croft Go - has rebranded as Studio Onoma fo…

Yeah they actually write it on their website that Onoma means "name" in greek. It is so stupid. Although...maybe it is better than, say, Plaion.

This name is the statement that they have complete creative freedom. Genius!btw, eurogamer reported that onoma just means "name" (in Greek)

Square Enix Montréal is now Studio Onoma following Embracer acquisition

Square Enix Montréal - the developer behind the likes of Hitman Go and Lara Croft Go - has rebranded as Studio Onoma fo…www.eurogamer.net

Embracinf anime now

animeuknews.net

animeuknews.net

Anime Limited Acquired by Plaion Pictures • Anime UK News

The purchase sees Anime Limited become part of a group owned by Embracer, and signals a sea change for the UK anime industry.

animeuknews.net

animeuknews.net